Brokers offer traders several benefits, like a gateway to access the market, essential analyses, educational resources, graphical representations of the live market, different trading options, and more. One of the key perks of trading with brokers is the ability to trade margins. Margin trading is an advanced trading technique that allows traders to trade assets with their brokers’ money. The strategy deviates from the most common way of trading, yet it is vastly popular among traders for its potential to yield high benefits. Let’s learn what margin trading is and how to use margin trading with proper risk management.

What is Margin?

While trading on a margin, traders borrow money from brokers after opening a margin account in a broker platform. To be eligible for borrowing, traders need to deposit a minimum fund in their margin account. This deposited fund is called a trader’s margin.

Depending on brokers, a trader can borrow a certain amount against their margin, which will be called his leverage. When offering leverage, brokers use the margin amount as security money, which they can take as collateral if the trade placed with the leverage goes southward.

Traders buying positions on the trading market with leverage or borrowed money need to pay additional interest set by the brokers initially.

For examples:

If a broker offers a maximum of 50% of your margin amount as leverage, and you have $500 in your margin account, you are eligible to borrow $250. To buy an order worth $12000, your margin fund has to be at least $8000.

How Margin Trading Works

In financial terms, margin trading has a broad definition, but when discussed on trading grounds, it emphasizes two specific types. Traders can use both types based on their understanding of the market condition.

Placing Orders with Leverage

Traders can take leverage to buy assets that project an imminent and strong uptrend possibility. This is the most fundamental margin trading type. It manifests traders’ confidence in their market analysis of a favorable market position.

Short Selling

In short selling, you borrow an asset from your broker and sell the borrowed amount in the market, predicting an imminent price fall. And when the price takes your predicted route, you buy the same amount of assets from the market and pay your debt to the broker keeping the gain.

Short selling is also a lucrative way to trade on margin. In this method, you borrow from your broker, providing margin as collateral in exchange for additional fees and interest rates.

How to Use Margin When Trading?

On most platforms, the margin trading process works similarly to regular trading but includes a few added requirements. To trade on margin, you should:

Learn How Margin Trading Works

Before risking your money, familiarize yourself with the process’s minute details by watching tutorials or accessing educational resources offered by your brokers. Leverages are double-aged swords. Wield it well, and it will add momentum to your earnings. And if gone wrong, it may cost you more than you expect. So, invest your money into learning the fundamentals, risk management procedures, and how the world financial market works, and practice what you learn by implementing the knowledge in a low-risk or simulated market.

Choose An Asset to Trade

Margin Trading exists in all trading markets—stock, foreign currencies, cryptocurrencies, or indices—due to its popularity among traders. Once you master the basics of the financial market and gain experience by trading in real-time, you will notice how, for a single occasion, market behaviour changes for varied assets. Before choosing an asset for trading on margin, put its price action into retrospect, be thorough with your scrutiny while understanding how the asset behaves against specific fundamental and technical changes, and from there, pick the right one with the optimal market position.

Create a Margin Account

Margins are executable only from margin accounts. Brokers keep the account opening procedures as minimal as possible, allowing easy access to trading margins. The basic process involves filling up a short form, providing verification info, and submitting the form. Once completed, the trader will instantly become eligible to place their first order.

Fund your Margin Account

Topping up a margin account is easy. Brokers may allow traders to fund a margin account via financial channels or transfer funds from their basic account; the latter is the most practiced. The available funds in your margin account will determine the borrowable amount or the maximum margin size. For example, if your trader allows for a margin with a maximum 1:10 ratio, and you have $100 in your margin account, you will be eligible to place an order worth $100 X 10 = $1000.

Place Your Trade

Now, you are all set to buy the asset at your desired amount. Once the price hikes, you sell it, make a profit, and pay the due date. The collateral, the margin amount, becomes tradable and transferable again.

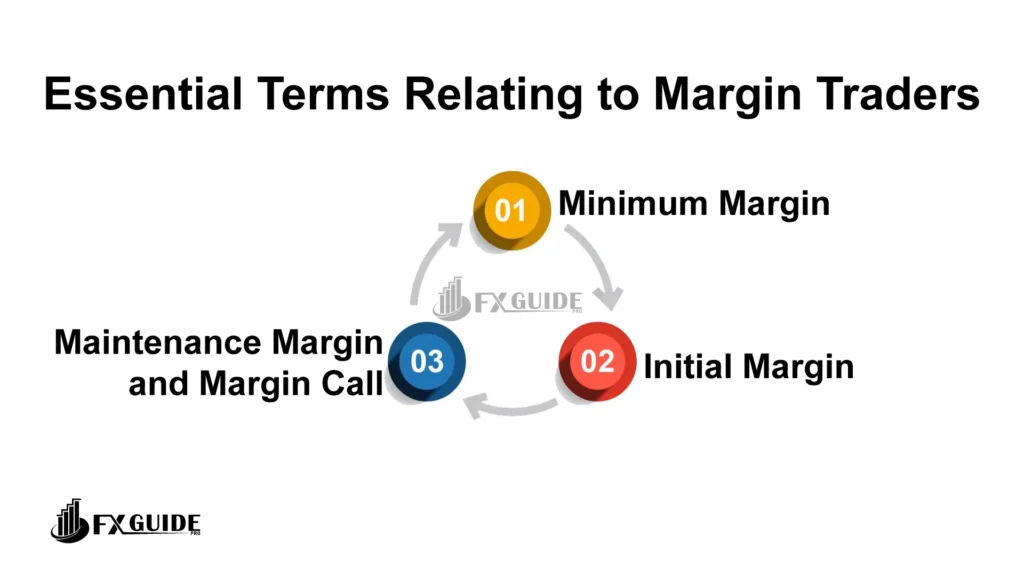

Essential Terms Relating to Margin Traders

The financial market is brimming with esoteric jargon that often befuddles traders, making their way through and around more difficult. There are a few such terms related to margin traders demanding a closer look into their definitions for executing trades with confidence. Let’s get into them:

Minimum Margin

The law mandates brokers ask for your permission to open a margin account in your name, regardless it is a sub-account running under the same agreement as your standard trading account or a completely solo account following a different agreement. As a means to demonstrate your consent, brokers set a minimum deposit amount, ranging from high to low, as a requirement to open an account. This required minimum deposit amount is called the minimum margin.

Initial Margin

Small or large, regardless of your order size, your brokers will never lend the amount of money to cover it 100%. Most brokers offer up to 50% of the total purchase money requiring you to deposit the rest to initiate the order, which is called the initial margin. For example, for purchasing an order worth $1000 with a broker offering leverage at a 60% initial margin, you have to deposit 60% of the purchase amount or $600 in the case of this example.

Maintenance Margin and Margin Call

A margin call is a warning from brokers to traders with active trades about the status of their account balance or trades. The maintenance margin is the minimum sustainable balance on a margin account. When a trade running on margin falls and becomes unsupportable by maintenance margin, the broker sends a margin call to the trader. It is a call or demand for an immediate margin refill, which, if unanswered, gives the broker the right to close the trade.

Pros of Trading on Margin

The decision to trade on margin is mostly made by traders who are confident of an uprising trend and want to buy beyond their available funds, using leverage from their broker. However, the benefits of margin trading far exceed that. Here are a few of them:

- Prospects of higher gain at low investment

- More purchasing power

- More flexible than regular loans

- Control over leverage capacity

Cons of Trading Margin

It will be a mistake if traders deal with margin trading, neglecting the associated risk. Traders should be aware of the conditions where they may have to pay more than just collateral money. Here are a few cons of margin trading:

- Failed trades will cost higher losses beyond the initial margin and leveraged amount

- Associated with service fees and volume-based interest rates

- Unanswered margin calls may close an active trade

- Brokers can interfere in a trade and sell their portion of shares

FAQs

Is margin trading profitable?

Margin trading offers higher gaining prospects than standard trading, allowing traders to borrow money from brokers and buy big market positions. However, it also involves greater risks and additional charges.

Why is buying on margin risky?

When a trader buys on margin only to observe a price fall, he has to pay more than just the collateral and the borrowed money. Based on the volume traded, he can be attributed with a large due amount, and brokers can sell or close any of his trades to mitigate loss.

What are the risks of margin trading?

Higher Losses: Losses are amplified just as much as gains.

Margin Calls: If losses exceed a certain level, the trader must deposit more funds or close their position.

Interest Costs: Borrowed funds come with interest charges, which can eat into profits.

Market Volatility: Sudden price swings can trigger liquidations quickly.

Conclusion

Margin trading provides traders with opportunities to make a profit that is impossible in a standard way. Traders get high purchase power against their deposit and can buy a larger portion of a profitable trend. But if things go wrong, the profitability of a trade on margin can quickly turn into a deadly pitfall. Traders ardent to leverage margin trading should spend time learning about different related concepts, how to use margin when trading and how financial markets treat margins. They should also learn about the risks and various risk management tools to ensure their trading safety.