Automation is redefining traditional ways of doing things. The immense power of AI is taking over all the technical parts of regular jobs, executing complex tasks with incredible precision and efficacy. Algobot is an AI trading assistant pioneering the advent of automation in the trading industry with features like autopilot trading, automated signal generation, and algorithm-driven trading strategies. Beyond its hype, we have looked into Algo Bot’s features and user experience, comparing it with its alternatives, and explained our findings in this detailed AlgoBot review.

What is AlgoBot?

AlgoBot is an AI-powered trading assistance tool, which traders can use on all popular trading platforms to automate the trading process. It uses a system that blends the power of artificial intelligence and machine learning streamlined for automated market analysis and decision-making.

Artificial intelligence takes care of the analysis part, while machine learning algorithms take notes from its success and failure cases and update its logic accordingly to yield more accurate results.

On behalf of traders, AlgoBot will watch over the market around the clock, enhance the functionalities of the host platform, look out for profitable opportunities, and place orders the moment it finds one.

How AlgoBot Works?

AlgoBot fuses multifarious analyses with AI functionalities to understand the market condition by scrutinizing essential factors. AlgoBot’s backtested algorithms show efficacy while concluding results received from different analyses and precision in making decisions based on its conclusions.

AlgoBot is available via third-party plugins compatible with the most popular trading platforms. Users can download and install those plugins in their preferred exchanges by following a few simple steps.

Once installed and activated, AlgoBot automation takes charge of your trading, watches over the market 24/7, and analyses every minute price change, saving you from the most boring part of trading.

It is worth mentioning that AlgoBot executes tasks based on strategies implemented in its algorithms. A vast collection of strategies formed upon established trading principles manifests in higher accuracy of signals provided and decisions made. Users can also receive these signals via a Telegram group and execute trades manually instead of automatically.

What Technical Indicators Are Used by AlgoBot?

As an automated system, AlgoBot excels at analyzing price actions through various trading indicators. Its system is a blend of well-written codes, artificial intelligence, and machine-learning algorithms that run independently while extracting market insights by comparing the current market data and historical trading data.

Here is a list of trading indicators AlgoBot uses to analyze the market:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

- Stochastic Oscillator

- Fibonacci Retracements

- Average True Range (ATR)

- Ichimoku Cloud

- Parabolic SAR

- On-Balance Volume (OBV)

- Accumulation/Distribution Line

- Commodity Channel Index (CCI)

- Momentum Indicator

- Williams %R

- Volume Weighted Average Price (VWAP)

- Keltner Channels

Key Features of AlgoBot

AlgoBot comes with powerful features capable of making intelligent decisions and automating executions.

State-of-the-Art Technologies

Trading bots are rather novel integrations in the trading field. AlgoBot, being one of the top AI trading solution providers, actively updates its services to ensure bug-free, impeccable executions.

Diverse Trading Analyses

AlgoBot signals are picked through automated market observations, keeping no scope for human emotions to meddle with the judgment. Its AI model is backed by all the major technical indicators commonly used across different trading markets.

Compatibility with Trading View

With an easy integration manual, traders can link AlgoBot with their TradingView accounts and receive automated trading signals on the platform. You can employ AlgoBot in your trading TradingView account in two ways:

Chart integration: With AlgoBot linked to your TradingView chart, traders have more power over their technical analysis process. They can even compare the results of their manual analysis efforts with the results provided by AlgoBot.

TradingView Alerts: You can also put your entire trading process on autopilot and turn on trading alerts. AlgoBot will analyze the market and alert you about promising trading situations.

Semi-Automated Trading

AlgoBot can provide optimal trading results when used as a semi-automated system. The semi-automated trading process follows a cycle: At the first step, an auto bot sends you trading signals to your Telegram account with detailed information about a profitable trade. The second step requires you to consider the signal and place it according to the instructions. The only limitation with this system is you have to be 24/7 ready to receive and place the orders.

Multi-market Adaptability

Regardless of which market you trade on, AlgoBot will cover you. With a simple integration process, you can use AlgoBot on any trading platform featuring the below markets:

- Forex trading market

- Crypto trading market

- Commodity trading market

- Indices trading market

- Stock trading market

Pricing of AlgoBot

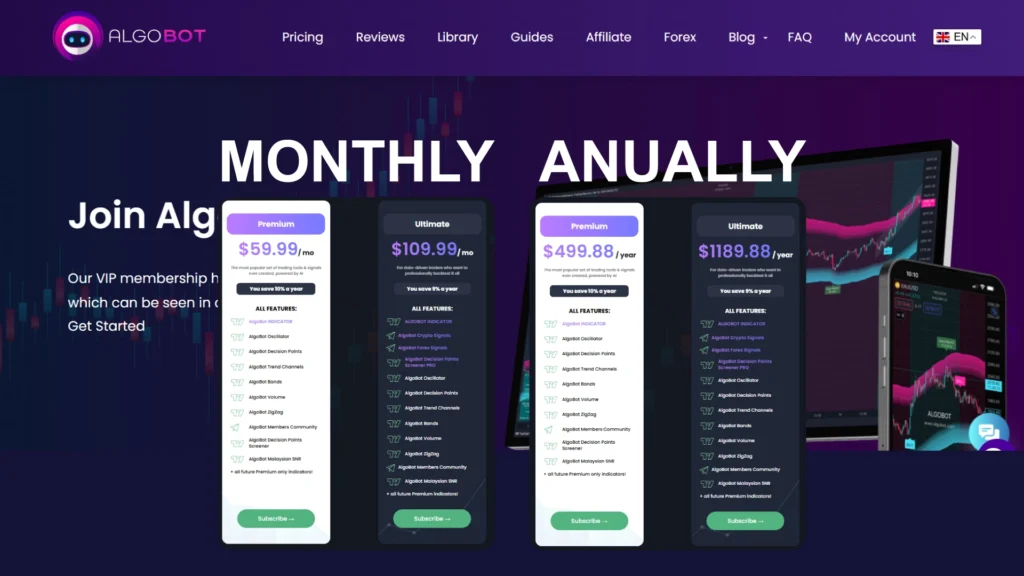

Saving the free version, AlgoBot’s packages are divided into two periodical segments: Monthly and Annual.

Premium Monthly Packages: Monthly packages are sorted into two divisions:

Premium: The most popular package includes technical indicators, access to the Telegram channel, a decision points screener, and Malaysian SNR for $59.99.

Ultimate: On top of the premium package, it provides the AlgoBot Indicator, trading signals, and the decision points screener’s pro version. It is priced at $109.99.

Premium Annual Packages: Annual packages are also sorted into two divisions:

Premium: The most popular package includes technical indicators, access to the Telegram channel, a decision points screener, and Malaysian SNR for $499.88.

Ultimate: On top of the premium package, it provides the AlgoBot Indicator, trading signals, and the decision points screener’s pro version. It is priced at $1189.88.

Why Should You Use AlgoBot?

AlgoBot has a few distinguishable features that set it apart from the other available options in the market. For instance:

Beginner Friendly

Aspirants with no knowledge of the trading market will find AlgoBot most useful as it executes trades exploiting analyses that take around a decade for regular traders to learn. AlgoBot gives beginners a chance to

24/7 Trading

Employing a trusted auto trading pilot to watch over the market and execute profitable trends gives traders a chance to do their other chores. With AlgoBot actively tracking, finding, and executing trades, traders can earn money even when they are asleep.

Risk Management Tools

AlgoBot offers multiple risk management tools, like stop-loss orders and take-profit orders, to reduce risk factors. While on autopilot, it uses data from multiple analyses and studies market patterns to position stop-loss orders and take-profit orders.

Disadvantages of Trading with AlgoBot

While all the features of AlgoBot are user-centric, the software is not beyond limitations. Users have to compromise and consider a few points when using AlgoBot. Here are they:

Things can go wrong: Given the software’s technical base, AlgoBot may sometimes unearth wrong signals, which, if traded blindly, may cut deeper into a trader’s pocket.

Price: Despite its free trading feature, AlgoBot’s premium packages are rather pricier than many other trading bots. Though it has a greater reputation than most other trading platforms, traders, especially beginners, may struggle to pay the price.

Less control: Traders who enjoy total control over their trading process will find AlgoBot intimidating.

Who Should Go for AlgoBot?

Unlike other trading assistance on the market, AlgoBot is designed to serve all classes of traders. You can become a client if you are a

Beginner: AlgoBot is the most suitable trading assistant for aspiring traders and newcomers. It doesn’t require traders to be experts to advance with their trading. A basic knowledge of technical analysis and how the market works will suffice.

Part-timer: You may have a full-time job or a full-length business and want to get into trading to increase your earning potential. AlgoBot can be a viable way to invest in the trading market without spending substantial time.

Expert Trader: You may have become a seasoned trading genius with your long years in the market. AlgoBot can still help you make more reliable decisions and bridge the gap between manual and automated trading systems.

A Curious Mind: If you are an experience seeker looking for ways to extend your horizon as a committed trader, you should go for AltGo. It is one of the finest trading tools empowered by AI features and offers a lot to explore in the transformation modern technology inspires in the trading field.

Pros and Cons of Using AlgoBot

Pros

- Over-the-counter performance

- Automated decision-making without being carried away by emotions

- Lucrative for both beginners and professionals

- Support for multifarious assets from different trading markets

- Frequent updates from the developers to keep the activities and performances streamlined

Cons

- Full accessibility comes at a price

- Will test your trust in times

- Can lead to wrong directions even during a major trend

- Not suitable for traders who want full control over their trades

FAQs

How Long Does it Take to Set up AlgoBot?

Installing AlgoBot takes only a few minutes. You must link your exchange account to its third-party platform.

What is the Minimum Amount You Need to Invest to Start Trading with AlgoBot?

The minimum amount you need to keep on your platform may vary depending on diverse parameters, including your exchange type and company. If the rest is assured, you can start trading at around $100 on average.

What Cryptocurrencies Are Tradable via AlgoBot?

You can trade all cryptocurrencies active in the market. AlgoBot constantly watches for updates to enlist the newly released cryptos, offering you the largest range of assets to trade on.

Is it Safe to Use AlgoBot for Trading?

AlgoBot implements the best preventive measures, ensuring impregnable security to protect clients’ data and accounts.

Conclusion

In your trading game, AlgoBot can be a true game-changer, saving you from tiring trading, analyzing procedures, and making big decisions. But you should also be aware of the risks included. Be mindful of your trading goals and risk tolerance.

You can start with the free version of the trading platform and open a demo trading account to test AlgoBot’s performance. It will give you a full demonstration of how it works, and you will learn all the basics without losing your money.

We recommend you do an in-depth analysis before getting involved with the platform. Once you get a good grip on it, you can revolutionize the way you trade on the financial market once and for all.