Forex Brokers are more than just your gateway to the Forex world. When you choose a broker, you choose to play by their rules. The choice will directly impact numerous aspects of your trading journey, which involve the sizes of your ROI, trading styles, the risks of falling prey to fraud, the possibilities of getting instant support, and so on.

The vast, open currency trading world is teeming with scammers who lure traders with their “get rich quick” schemes. Careless stepping on their traps is one of the primary reasons for many traders’ unexpected bankruptcy. To stay safe, traders must opt for brokers regulated by reputable financial bodies with an unquestionable track record.

FX Guide Pro seeks to help traders find reliable Forex brokers and suggest the best ones that support different trading styles and goals. We have conducted in-depth research and extracted 5 Forex brokers 2025 that have stood firm in the face of diverse tests of time and met all the parameters to be a great broker company. Let’s learn why these brokers are your best options and how they differ from the others.

List of Top 5 Forex Brokers 2025: Features, Pros and Cons

IC Markets: Top Rated Broker for Short-term Trades

Trustpilot Rating: 4.8

Minimum Initial Deposit: $200

IC Markets is an Australia-based broker service operating with a recommendable rating. Features like low spread, massive product selection, and straightforward account opening process have made it a top choice among beginners and professionals.

Desktop traders will get an MT4 platform with all the convenience of the web trading platform. For mobile traders, IC Markets has developed a mobile trading platform based on the same MT4 functionalities. The user experience and interface of both platforms maintain efficiency to be on par with any standard and premium platforms offered by market peers.

IC Markets demands a minimum of $200 initial deposit for account opening regardless of the type and features. However, it has integrated a wide range of funding and withdrawal methods, stripping off struggles on the traders’ sides.

Country Coverage

Traders all around the world can use IC Markets except the USA, Iran, Cuba, Syria, Sudan, and North Korea.

Regulatory Body

IC Markets has acquired several licenses to provide worldwide trading access. However, all the regulators are non-major and off-shore types, so traders shouldn’t blindly rely on these jurisdictions and make cautious decision while investing big amounts.

Australian Securities and Investment Commission(ASIC): Based in Australia, IC Markets follows guidelines and regulations imposed by the Australian Securities and Investment Commission (ASIC).

Seychelles Financial Services Authority (FSA): The financial governing body of the island country Seychellas has licensed IC Markets as a global entitiy to provide Forex brokerage services.

Cyprus Securities and Exchange Commission (CySEC): The Cyprus Securities and Exchange Commission (CySEC) backs IC Markets operations for European residences.

Pros of IC Markets

- Backed by major and secondary regulatory bodies

- Competitive pricing and spread level

- Integratable third-party analysis tools

- MT5, cTrader, and TradingView support

- Diverse assets to trade on

- Comprehensive mobile app

Cons of IC Markets

- Often follows other brokers’ trails in researching and teaching methods

- Doesn’t offer a proprietary Forex trading app

- Limited trading scopes for AU traders

Why Choose IC Markets?

If you are looking for a top-rated broker with strong regulatory status and operable from most countries, IC Markets will be a viable choice. Its scalable execution procedures and competitive pricing have cut a good name among worldwide traders.

XTB: Acclaimed for Low-Cost Schemes and Beginner Friendly Platform

Rating: 4.0

Minimum Initial Deposit: $0

XTB is among the few brokers that don’t demand commissions for trading through standard accounts. To boast recognition as the least demanding trading platform, it maintains zero-to-minimum service charges for most of its features, including a no-deposit initiation offer. Traders who appreciate or need a low-cost trading platform without considering credibility and experience will find XTB just on par.

XTB is a Polish trading platform that has been providing cost-resilient Forex trading access for around two decades since its first appearance in 2004. Headquartered in Warsaw, Poland, XTB stands apart by nurturing its vision to provide and sustain a trader-friendly platform, keeping all charges to the bare minimum. It also follows strict regulations through its transaction funnels and offers a streamlined trading experience.

Besides its comprehensive and authoritative trading platform, XTB aspires to educate traders through vast educational resources, like webinars, market analysis, and tutorials. These resources teach beginner-to-advanced-level topics to help traders be more skilled in their trading endeavours.

Covering Countries

XTB is a globally available brokerage entity with offices in 11 countries, including the UK, Poland, Spain, France, Turkey, Portugal and Germany. While bringing access to worldwide traders, XTB doesn’t accept clients from a few countries, such as the USA, India, Indonesia, Pakistan, and Syria.

Regulatory Body

XTB welcomes several supervisory authorities to regulate their services and transactions to reflect transparency. Traders can take different judiciary coverage based on their locations.

Financial Conduct Authority (FCA): XTB is licensed by the UK’s Financial Conduct Authority (FCA) as an attestation to reliability towards the traders residing in the UK and other parts of Europe.

Cyprus Securities and Exchange Commission (CySEC): European countries that are not observed by FCA will be covered by the Cyprus Securities and Exchange Commission (CySEC).

International Financial Services Commission in Belize (IFSC): Traders residing in non-European countries can take coverage of the International Financial Services Commission in Belize (IFSC).

Pros of XTB

- Feature-rich platform with diverse functionalities

- Minimum service charges

- Diverse analysis tools and research capabilities

- Backed by FCA, CySEC, and IFSC

Cons of XTB

- Fewer opportunities for social traders

- Charges for inactivity

- Scarce funding methods

Why Choose XTB?

XTB brands its services as one of the lowest-demanding brokers in the market with tight spread costs, minimal trading fees, and low swap charges. They also provide generous discounts on different features to active traders. In addition, XTB doesn’t charge extra for withdrawal and wire fees. If you need a reliable broker that asks for the minimum service charges, XTB will be a perfect choice.

AvaTrade: Best Beginner-friendly Platform

Trustpilot Rating: 4.7

Minimum Initial Deposit: $0

AvaTrade is an Irish broker house based in Dublin and has been a renowned name among Forex traders since 2006. Trusted with a straight 4.7 TrustPilot rating, AvaTrade offers a well-rounded trading experience. Taking a low-cost service approach and developing a beginner-friendly interface, AvaTrade is considered the best trading platform for newcomers.

To help grow, AvaTrade has built an archive with educational resources, including a range of articles, videos, webinars, answers to common questions, tutorials, and eBooks. Aspirers will also find a substantial amount of resources on different market analyses and their applications in daily trades.

Another notable feature that holds AvaTrade’s empathic sentiment towards newcomers is its incomparable customer care. Beginners tend to require more support in their early trading days due to their limited understanding of the Forex market and trading procedures. AvaTrade excels in providing instant support dealt with by experts in multilingual communications.

The initial $100 charge on account opening may hurt the inspiration of being a beginner-friendly platform; however, charges on trades and swaps are minimal. An inclusive set of assets awaits to be traded at a minimum or zero cost.

Country Coverage

AvaTrade has a massive global reach that exceeds its competitors’ active users. Traders all around the world, except citizens of Belgium, Cuba, Iran, Syria, New Zealand, Russia, Belarus, Lebanon, and Yemen, can opt for AvaTrade for its unbeatable services.

Regulatory Body

AvaTrade answers to several international financial governing bodies to provide trading access all over the globe. Here are the major ones:

Central Bank of Ireland(CBI): Licensed by Ireland’s Central Bank, AvaTrade runs operations throughout Europe, being compliant with the Markets in Financial Instruments Directive (MFID).

Polish Financial Supervision Authority (PFSA): AvaTrade runs from its Polish Branch through the license authorized by the Polish Financial Supervision Authority (PFSA).

Australian Securities & Investment Commission (ASIC): AvaTrade has obtained a license from ASIC for its acceptable procedures for managing transparent trading actions for Australian citizens.

British Virgin Islands Financial Services Commission (B.V.I.): For accessing the UK citizens, AvaTrade operates under the licence of British Virgin Islands Financial Services and Commission.

Pros of AvaTrade

- Low pricing on active trading

- Extensive resource for supporting traders’ growth

- Convenience of using a demo account

- Unparalleled customer support

Cons of AvaTrade

- Included inactivity fees

- The number of tradable assets may seem limited

- Unavailable in the USA

Why Choose AvaTrade?

AvaTrade is the best choice for beginner traders who need trading opportunities at a low spread level and with minimum interest. Its all-around educational resources accelerate a trader’s growth from the ground up.

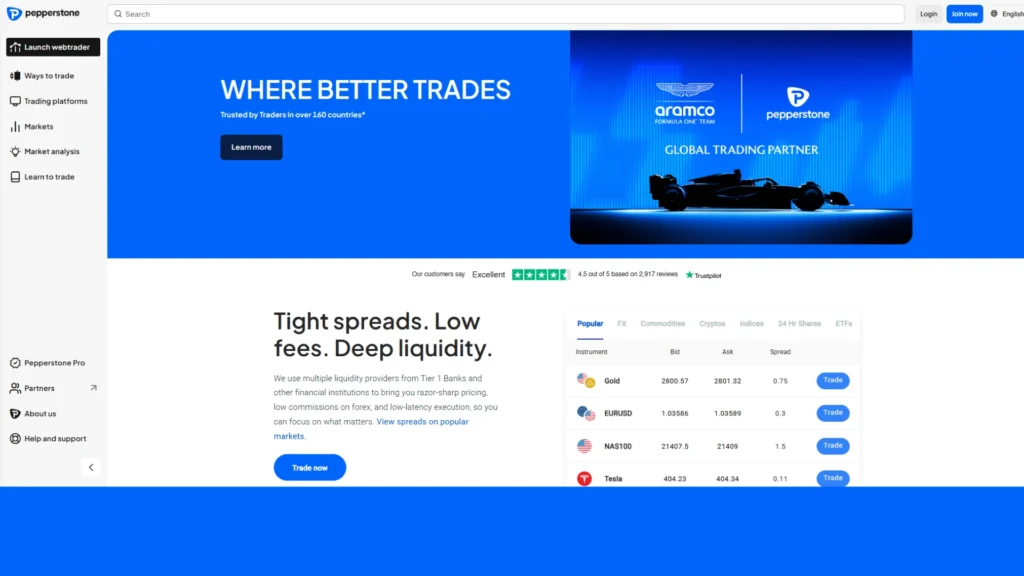

Pepperstone: Diverse Features for Advanced Traders

Trustpilot Rating: 4.7

Minimum Initial Deposit: $0

Papperstone is a well-known, popular Forex broker company headquartered in Melbourne, Australia. It has been the epitome of a reliable trading broker since 2010 and it keeps up with its reputation without compromising the parameters of a good broker.

With Pepperstone, traders will get access to all the major trading platforms, essential analyses, and automated functionalities. Prolific traders who trade big volumes on a regular basis and appreciate quick executions will love Pepperstone. Sighing up for a premium Razor account will justify heavy-frequency trading with firmly tightened spreads.

Risk traders with a knack for investing in spanning price actions ranging from intraday to multiple days or weeks can leverage Pepperstone’s advanced risk management tools. In exchange for a little surcharge, the platform provides exemplary stop-loss orders, executing precise market exits.

One unique gesture on behalf of Pepperstone is rewarding high-volume and active traders with rebates and discounts. Its partnership with platforms like MyFxBook and DupliTrade makes it a trading haven for social traders.

Country Coverage

Pepperstone offers trading access to global audiences while keeping its reputation intact. To cut the clutter and ambiguity, the platform restricts several nations from opting for its service. Here is a detailed list of the prohibited nations:

United States, Afghanistan, American Samoa, Canada, Congo, Central African Republic, Cote d’Ivoire, Crimea, Democratic People’s Republic of the Congo, North Korea, Eritrea, Guinea-Bissau, Iran, Iraq, Japan, Kazakhstan, Lebanon, Liberia, Libya, Mali, Myanmar, New Zealand, South Korea, Somalia, Sudan, Syria, Yemen, or Zimbabwe.

Regulatory Body

Pepperstone follows strict regulative boundaries and ensures a safe and protected trading journey for traders. Here are a few notable regulatory bodies that dictate Pepperstone’s activities:

Financial Conduct Authority (FCA): FCA gives Pepperstone access to be operative in the European zone and provide safe access to UK citizens.

Australian Securities and Investments Commission (ASIC): Pepperstone uses an ASIC license to get Australian citizens onboard and ensure a hassle-free trading experience.

Dubai Financial Services Authority (DFSA): Pepperstone has also achieved the rare license of DFSA as a demonstration of its quality service.

Cyprus Securities And Exchange Commission (CySEC): Through the CySEC license, Pepperstone conducts activities in offshore European countries.

Capital Markets Authority of Kenya (CMA): CMA permits Pepperstone to let African traders get access to the Forex market.

Pros of Pepperstone

- Enables users to integrate assisting third-party plugins

- Global coverage achieved through reliable licenses

- Minimum spread rate and several types of accounts designed to meet the necessities of different strategic traders

Cons of Pepperstone

- Restricts the US residents

- Limited assets as CFDs, Cryptocurrencies, and stock are not tradable

Why Choose Pepperstone?

Pepperstone boasts cutting-edge and widely used trading analyses and functionalities, ensuring the fastest trade executions. Traders who need a feature-rich platform with support for third-party plug-ins and tool integrations should pick Pepperstone any day.

Forex.com: Best for Cross-platform Trading Experience

Trustpilot Rating: 4.7

Minimum Initial Deposit: $100

Established in 2004, Forex.com has earned a name for its over-the-top trading services. The company behind Forex.com, Gain Capital, owned by StoneX, runs Forex.com from its New York headquarter. With a record of providing decades of transparent services, Forex.com has established itself as a reliable Forex broker.

Forex.com offers comprehensive coverage of various markets and assets. Traders can find more than 80 currency pairs tradable at a very low spread and leverage products like spread trading and CFDs on Forex.com.

Regulated by financial bodies of all the major countries, including the USA, the UK, Canada, Japan, Australia, and a few other offshore countries, Forex.com demonstrates its commitment towards

Fees and Commissions

Traders can trade over 80 major and minor currencies at a low spread. For many pairs, traders will have to pay as low as 0 spread count.

Country Coverage

Forex.com is available in over 180 countries with no or negligible restrictions for most nations.

Regulatory Body

Forex.com has built an impenetrable protective trading infrastructure by acquiring licenses from several countries’ financial regulatory bodies. Traders can entrust these bodies for their active and strict quality and transparency preserving regulations.

Canadian Investment Regulatory Organization (CIRO): The CIRO protects Canadian residents’ financial rights and takes action in cases of fraud and trading discrepancies.

Cyprus Securities & Exchange Commission (CySEC): CySEC takes liability for any mishaps held against European citizens.

The National Futures Association (NFA): The USA’s assisting financial regulatory body working on behalf of the Commodities Futures Trading Commission (CFTC) to provide protection during currency trading.

Cayman Islands Monetary Authority (CIMA):

Financial Conduct Authority (FCA): FCA see through all the trading activities and regulate them to ensure safe trading experience to the UK citizens.

The Financial Services Agency (FSA): FSA ensures safe trading for the residents of Japan.

The Monetary Authority of Singapore (MAS): MAS is Singapore’s financial regulatory institute that inspects Forex.com’s activities and provides protections to Singapore’s citizens.

The Australian Securities and Investments Commission (ASIC): ASIC champions the financial rights of Australian citizens.

Pros of Forex.com

- Versatile mobile app platform

- Diverse technologies to offer the best user experience

- Backed by several strict regulators

- Efficient performance analysis convenience

Cons of Pros of Forex.com

- Requires a high account balance to be eligible for earning interest on unused cash

- Discounts are only offered on high-volume trades

- US residents don’t get specific stop-loss orders

- US traders can only engage in spot trades

Why Choose Pros of Forex.com?

For traders who would love on-the-go trading experience, Forex.com offers the most user-centric mobile app support. Integrating all the usual features of a full-on trading platform, Forex.com’s mobile app solves a fundamental problem for traders by letting them trade on-route.

FAQ

What to Look for While Choosing a Forex Broker?

Look carefully into the most optimal brokers’ regulatory models, features of their trading platforms, deposit and withdrawal processes, and customer support.

Is Forex Trading Legal in All Countries?

No, many countries don’t legalize trading on the Forex and other speculative markets, while most of them allow brokers who are authorized by reliable financial bodies.

What is a Minimum Deposit?

A minimum deposit is the required amount a trader must deposit before opening an account on a trading platform. Depending on brokers and the type of account, the minimum deposit amount can vary.

How to Avoid Scam Brokers?

Check their past and current performance track records and regulatory status. Check reviews on reputed websites and communicate with existing and former users.

Can I Trade Forex on My Phone?

Yes, many Forex brokers, such as Forex.com and IC Markets, offer mobile trading platforms with comprehensive features that let their clients trade on the go.

Conclusion

Failing to choose the right Forex broker can put your trading career at risk by making you spend extra. The right broker not only protects you from invisible money loss but also provides assistance and support in accordance with your trading strategy. Before choosing a broker, take time to scrutinize your personal goals, trading practices, and level of expertise. Also, research a broker’s reliability, look into their offers and features, and pick one that resonates the most with your demands and necessities. The top 5 Forex brokers 2025 mentioned above have passed the test of time with their service’s efficiency and convenience. In case of doubt, you should go even deeper with your research on each of them before opting for one.